[dropcap size=big]M[/dropcap]oney can be a huge source of stress and anxiety for college students, and a 2015 report from the National Student Financial Wellness Study found over 70 percent of college students feel stressed by their financial situation. That shouldn’t come as a surprise given the cost of pursuing a college degree: In-state tuition at WKU is nearly $11,000 per year.

Luckily, this stress can be minimized — or even avoided — if you’re organized with your finances.

But how do you achieve this stress-free nirvana? A simple budget is a good place to start.

First things first: What is a budget?

A budget is simply a method of figuring out how much money you make and how much money you spend.

Without a budget, you’re likely left just spending money as you make it, which can result in money being pretty tight near the end of a pay period. A little bit of planning can make your life a lot less stressful at the end of the month. By employing a simple, straightforward budgeting method, you can easily figure out how much money you make, how much you spend and how much you should have left over.

How do I create a budget?

There are two major components to any budget:

- Income: the amount of money you earn

- Expenses: the amount of money you spend

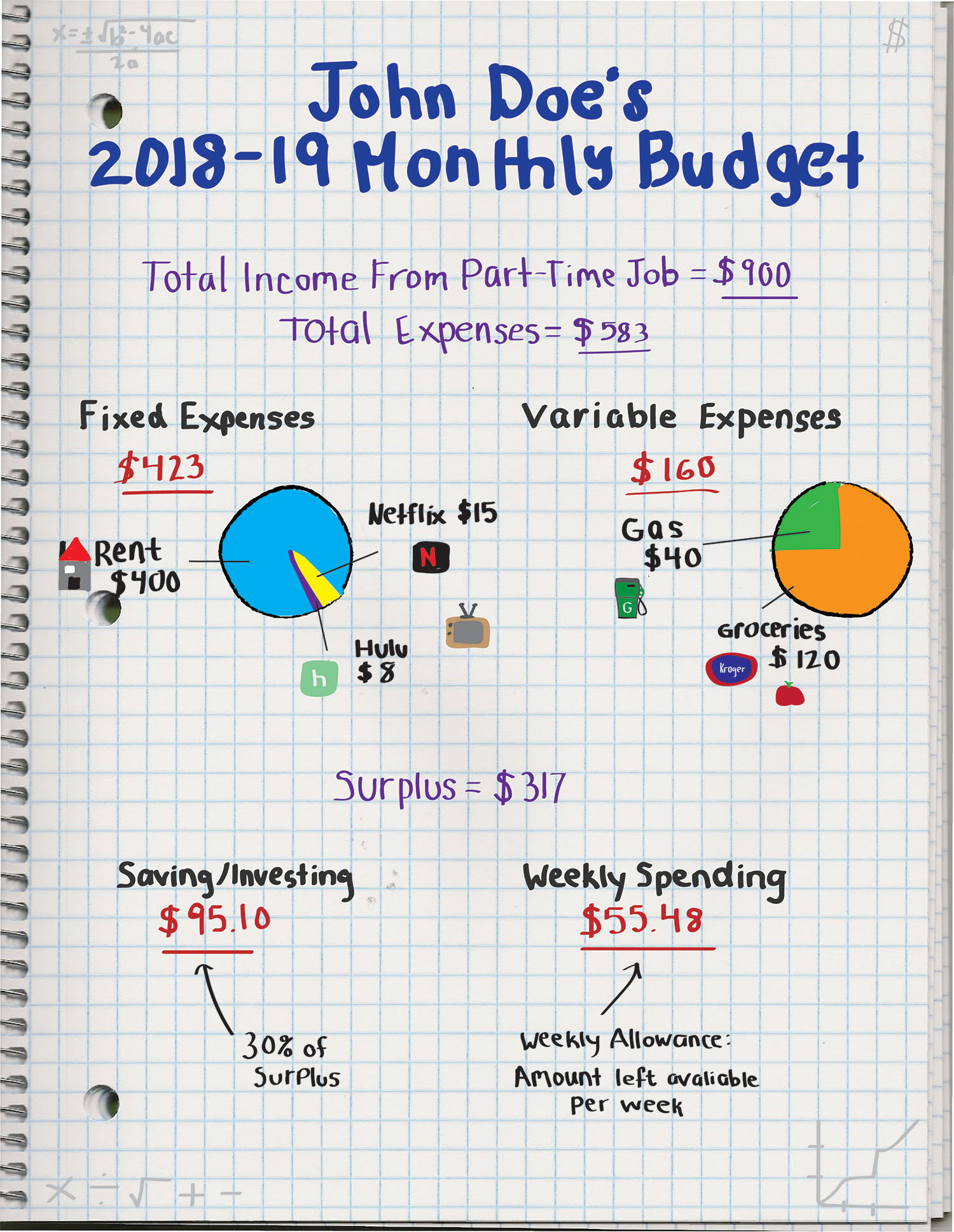

The first step when creating a budget is to figure out your monthly income. For the typical college student, income often comes from a part-time job, a sympathetic parent or financial aid (but don’t spend all that financial aid money at once). Regardless of how the money ends up in your pocket, it’s up to you to spend it wisely. When calculating your income, be sure to include expected paychecks from your job and any other money you regularly receive.

Next, you need to determine your expenses.

There are two critical categories that make up your expenses: fixed costs and variable costs. Fixed costs are the payments that you make in the same amount every month, such as your rent or car payment. Variable costs are the things that change in cost each time you buy them, such as gas and groceries.

After calculating your fixed costs and variable costs, you should have a firm grasp on your essential expenses for each month.

In general, you should try to overestimate your expenses and underestimate your income, that way you get a pleasant surprise at the end of the month instead of the realization that you’ve gone over your budget.

What about the money that’s left over?

Now comes the fun part. Whatever money you have left over after subtracting your regular expenses from your income is your “surplus,” or the money you get to spend on what you want to buy. This is also the money that you can earmark for saving/investing (which, of course, I highly encourage).

For the surplus part of your budget, it’s important to find what works for you. I recommend setting aside at least 25 percent of this surplus to save or invest.

After taking out the money you plan to save, you can break down the rest for your non-essentials, or the things you spend money on that you don’t really need, like buying new shoes or going out with your friends.

It may be best to split this spending money into weekly chunks, rather than monthly chunks. So if you have $160 left over every month, you have $40 a week to spend on things like going out to eat or seeing a movie. Keep track of the money you are spending to make sure you don’t go over budget. You might find that you have more money than you thought!

Creating a budget is easier than you think, take a look at this example budget:

Are you still having budgeting issues, or do you want more personalized help with your budget? WKU has a Center for Financial Success specifically designed to help students with budgeting/financial planning! Their office is in Grise Hall room 320, or you can fill out a form to schedule an advising appointment here.