Scared of the stock market? Here’s a way to protect yourself

Before you dive into the world of investing, it’s important to recognize that investing doesn’t come without risk. Temporary shifts in the market can inflate or deflate the balance of your profile over the course of just a few short hours. Anything from earnings reports to new government legislation or a successful ad campaign can quickly move the value of a particular stock — for better or for worse.

Some people seek this risk; after all, fluctuations in the market mean a greater opportunity for profit. The oft-repeated maxim of “buy low, sell high” comes from this very principle. However, not all of us have the stomach (or the bank account) for such endeavors.

While eliminating risk may not be possible, there are certainly ways to minimize it.

Why are individual stocks risky?

Picking individual stocks is risky largely because you are counting on that particular company to perform well in the future. The risk of the company struggling and the value of the stock dropping or the company even going out of business is a real possibility. If you own stock in a company and that company goes out of business, all that money that you invested is gone. So, you definitely don’t want to be caught holding the bag.

What’s the solution?

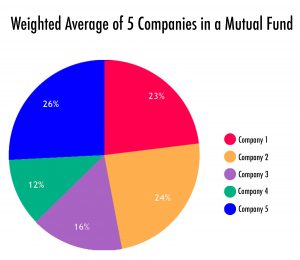

Through mutual funds, you can put your money in the market as a whole instead of investing in a single individual company. A mutual fund, put simply, is a portfolio of tens, hundreds or even thousands of companies. The growth of the mutual fund is determined by a weighted average of all the stocks that make up the portfolio. A weighted average means that the amount of influence a single stock has on the portfolio is determined by its relative value instead of the just number of stocks in the portfolio.

For instance, let’s say there’s a mutual fund that contains a portfolio of stocks worth $1,000 in total. If a particular stock is valued at $50 a share, then that stock makes up 1/20, or 5 percent, of the total mutual fund, regardless of whether the fund consists of 10 stocks or 50.

While that may sound complicated, it is actually often less work to invest in mutual funds than in individual stocks because they require less monitoring and research on individual companies for you.

These mutual funds are created by investment companies and can cover a wide variety of markets. For example, if you want to invest in energy stocks or tech stocks, you can invest in a mutual fund that combines a bunch of these individual companies into one asset. There are even mutual funds that encapsulate all public U.S. companies, such as all the companies listed on the New York Stock Exchange, so your money is diversified to the furthest extent.

Why mutual funds?

Diversifying your assets sounds complicated, but really it just means that you aren’t putting all your money in one place. If you invest all your money into Microsoft stock, your financial wellbeing is entirely dependent on how that one company performs. If you diversify your investments, like by using mutual funds, you protect yourself against the risk of an individual company struggling.

Mutual funds are one of the easiest ways to minimize risk since you are basically investing in the future of the entire United States economy, not just an individual company. Of course, the market itself is not immune to temporary drops. However, mutual funds protect you from the risk of companies going bankrupt, or other severe downturns. It is much easier to predict the eventual bounce-back of the economy as a whole, rather than of individual companies.

The above graph shows changes in the Dow Jones Industrial Average (a typical way to represent the U.S. stock market) over the last 30 years. In general, the market as a whole tends to rebound, even as individual companies go out of business.

While the stock market can never be risk-free, diversifying your portfolio through mutual funds is a great way to limit your risk and protect your money. Any major investment company, such as Vanguard or Fidelity, will have mutual funds available for you to invest in! To find out what mutual funds a specific investment company offers, just visit their website.